43+ difference between trust deed and mortgage

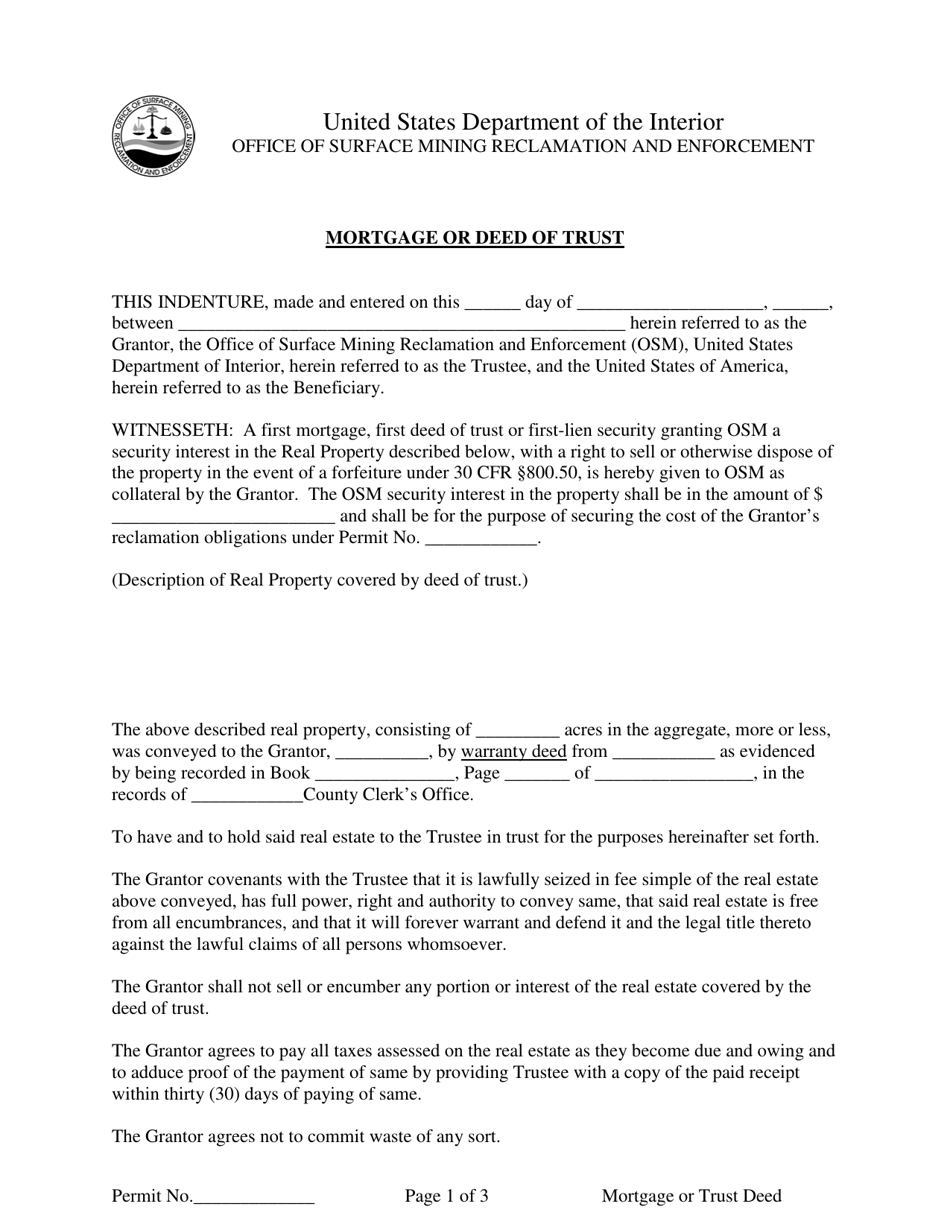

Many states allow either choice. This document is used instead of a mortgage in some states.

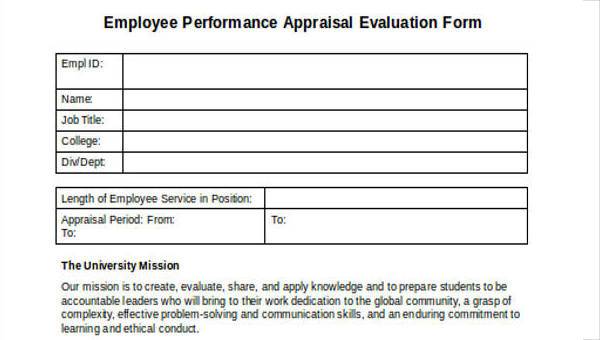

Free 43 Evaluation Forms In Ms Word Pdf Excel

Web The big difference between these two real estate documents is that a deed of trust requires a third party a trustee whereas a mortgage does not.

. A mortgage requires a. This method is confined to dual-party operation since another party lends commonly known as the mortgagee. A borrower sometimes known as a mortgagor is one of the parties.

A trust deed has three parties. How does a deed of trust work. Web In a deed of trust the trustee temporarily holds the title on the property and hands it over to the borrower once the loan is repaid in full.

Both have a different number of parties involved. The second is what happens in the event that the borrower cant pay. The borrower and the lender.

A beneficiary lender a trustor borrower and a neutral third party known as the trustee usually a title or escrow company. A mortgage and a deed of trust will only really affect the homeowner should the homeowner default on their loan and have to foreclose. The borrower and the lender whereas deeds of trust involve 3 parties.

A borrower the Mortgagor and a lender or investor the Mortgagee. Scribd is the worlds largest social reading and publishing site. Web Mortgages and Deeds of Trust Have Two Major Differences.

Deeds of trust arent loans. Normally when a property is sold the title company will see the note on title whether a mortgage or deed of trust and pay it out. A borrower the Trustor a lender or investor the.

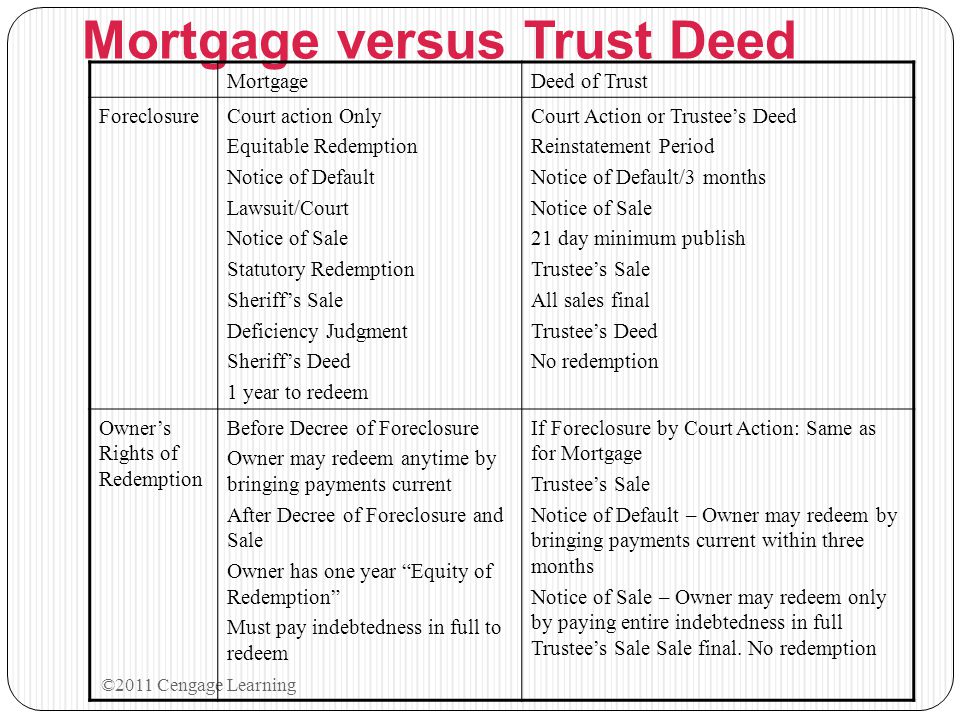

Web Mortgages require the use of a judicial foreclosure process while deeds of trust are used in states that allow non-judicial foreclosure. The type of foreclosure youll face depends on whether you have a deed of trust or a mortgage note. Web The difference between mortgage and deed of trust is that there are just two people engaged in a mortgage transaction.

Web There are a few key differences between deeds of trust and mortgages. While a mortgage and a deed of trust have similarities they also have a few things that set them apart. A mortgage is an agreement between a borrower and lender while a deed of trust involves a trustor beneficiary and trustee.

This makes sense because when the borrower defaults on a mortgage the lender needs to first wrest ownership of the property from the borrower before foreclosing on the property. Web difference between a mortgage and deed of trust - Read online for free. A mortgage has two parties.

Usually a mortgage only has two parties involved the lender and borrower. Web To put simply the deed is the legal document that proves who holds title to a property while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home. When a homeowner defaults on their loan the lender then has the.

Heres a breakdown of some of the most important differences. Web A deed of trust is a legal agreement thats similar to a mortgage which is used in real estate transactions. A mortgage involves only 2 parties.

Web Deed of Trust vs. The individuals involved in the financing process. Web If you have a deed of trust youll typically face a nonjudicial foreclosure.

Trust deed involves the loans non-judicial foreclosure in a speedier cheaper way. Web There are however a number of differences between the two. Web Parties involved.

Deeds of trust are usually faster and cheaper for the lender. Web First a trust deed is different from a mortgage in the number of parties involved in the contract. Foreclosure length and expense.

Although a mortgage is considered a type of loan a deed of trust is not a loan its an agreement. A deed of trust is a trio. Although mortgages and deeds of trust accomplish the same goalto make your home a source of repayment if you default on the loanthey differ in two major respects explained below.

Web In a deed of trust as with a mortgage the borrower makes monthly loan payments to the lender. This process is generally time-consuming and expensive. The trustor the borrower the lender sometimes called.

Thanks to an easier foreclosure process many lenders prefer a deed of trust to a mortgage. Web A Mortgage involves two parties. A mortgage has a judicial foreclosure and a deed of trust has a nonjudicial foreclosure.

However the trustee holds the title to the property to the trustee while the borrower makes. Not all homeowners require a mortgage and you do not necessarily need to have your name on a mortgage if your name is on a deed. There are two major difference between a mortgage and a deed of trust.

Number of Parties Involved A mortgage has just two parties. The Parties Involved In the Transaction. A Trust Deed involves three parties.

Web A mortgage involves you and the lender but a deed of trust adds a neutral third party that holds title to the real estate. Web A mortgage is a loan while a deed of trust is not. On the other hand for a mortgage the lender will need to go through the courts.

The borrower lender and trustee. A mortgage is a two-some. The other major difference between the two can be seen in the foreclosure process.

Web The primary difference between a trust deed vs mortgage is the foreclosure process. A lender and a borrower. First some mortgage basics.

A mortgage requires judicial foreclosure of the loan which is time-consuming and costly. The first is how many parties are involved. Again while a mortgage involves two parties a deed of trust involves three.

A judicial foreclosure is a court-supervised process that is enforced when the lender files a lawsuit against the borrower for defaulting on their mortgage. Deeds of trust are not available in every state. Web Under a deed of trust the property can be sold if the borrower is in default without going through a costly legal procedure.

Whereas a mortgage only involves the lender and a borrower a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults. Difference between a mortgage and deed of trust. When you have a mortgage your lender will need to seek a judicial foreclosure to take back your property.

Web The most significant difference would be that mortgages and trust deeds have different foreclosure processes. The process is known as a nonjudicial foreclosure. Web A deed of trust pledges real property to secure a loan.

Web In title theory states Deeds of Trust are the binding agreements utilized between lenders and borrowers and Mortgages are the agreements utilized in lien theory states.

Deed Of Trust Vs Mortgage Bankrate

Free 43 Sample Hr Forms In Pdf Excel Ms Word

What Is The Difference Between A Deed And A Deed Of Trust Legal Beagle

Trust Deeds Vs Mortgages What S The Difference

Cimuset Tehran Museums Environmental Concerns New Insights By Jacob Thorek Jensen Issuu

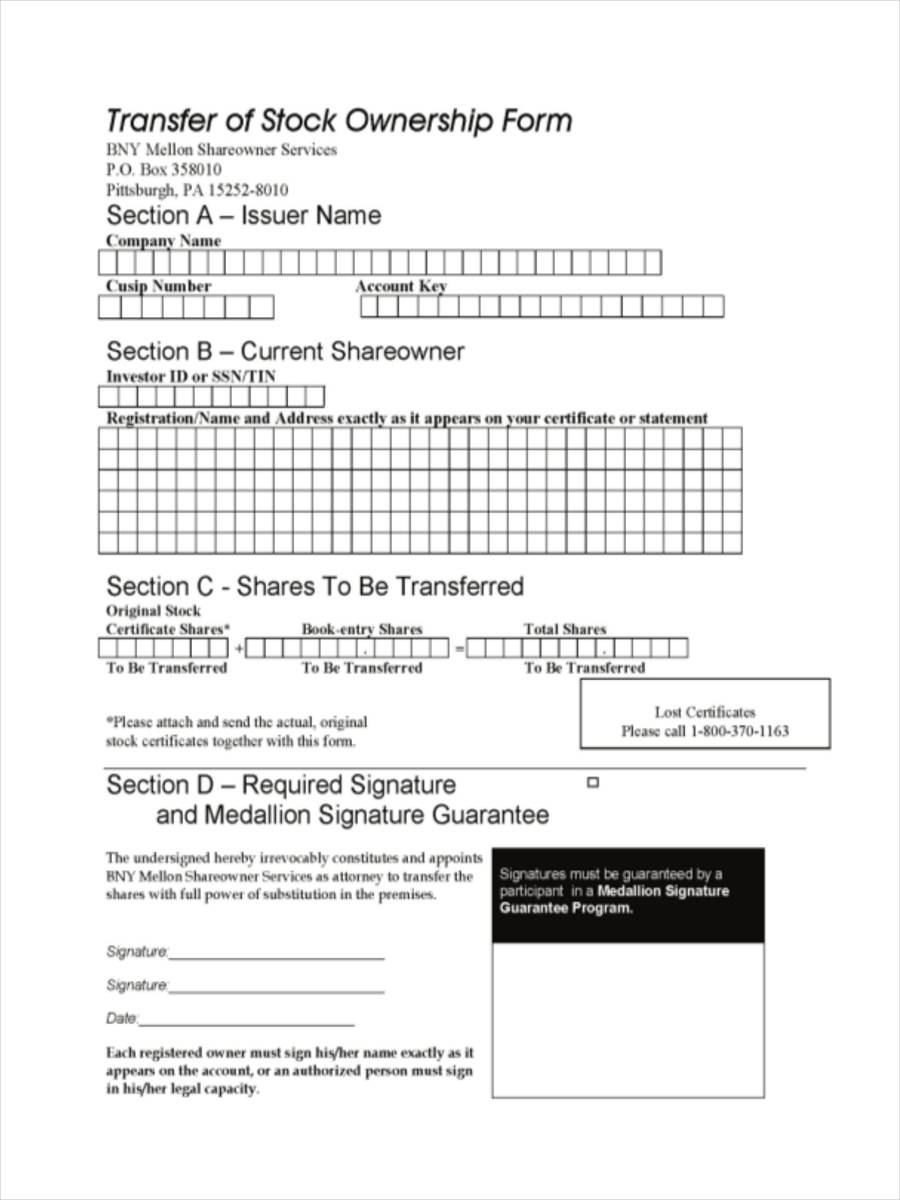

Mortgage Or Deed Of Trust Download Printable Pdf Templateroller

Trust Deeds Vs Mortgages What S The Difference

Mortgages And Deeds Of Trust Youtube

Difference Between A Mortgage And A Deed Of Trust Difference Guru

Deed Of Trust Vs Mortgage What S The Difference Credible

Mortgage Or Deed Of Trust Download Printable Pdf Templateroller

1385 Scott Road St Johns Fl 32259 Compass

33 Sample Deed Of Trusts In Pdf Ms Word

2011 Cengage Learning Ppt Video Online Download

Can I Get A Mortgage If I M In A Trust Deed

Trust Deeds Vs Mortgages What S The Big Difference

What Is A Deed Of Trust Lendingtree